Cpp Percentage 2024

Cpp Percentage 2024. Cpp payments have increased by 4.4% in 2024 compared to 2023. As an employee, how much will your cpp contributions increase in 2024 based on your income?

For 2024, that means a maximum $188 in additional payroll deductions. This increase is much higher than we have seen in recent.

Cpp Deductions Are Based On A Percentage Of Your Income Up To The Maximum Pensionable Earnings Minus The 2024 Basic Exemption Amount Of $3,500.

Overall, people earning over $73,200 will be contributing an extra $300 in 2024, compared to their.

If You Are An Employee, You And Your Employer Will Each Have To Contribute 5.95% Of Your.

Overall, people earning over $73,200 will be contributing an extra $300 in 2024, compared to their.

A Set Percentage Of One's Annual Pensionable Earnings Should Be Contributed To Cpp.

Images References :

Source: advisorsavvy.com

Source: advisorsavvy.com

Advisorsavvy How to Calculate CPP Benefits, Overall, people earning over $73,200 will be contributing an extra $300 in 2024, compared to their. In this article, we’ll cover everything you need to know about cpp and ei rates in canada, including cpp contribution rates, maximums, and exemptions in 2024.

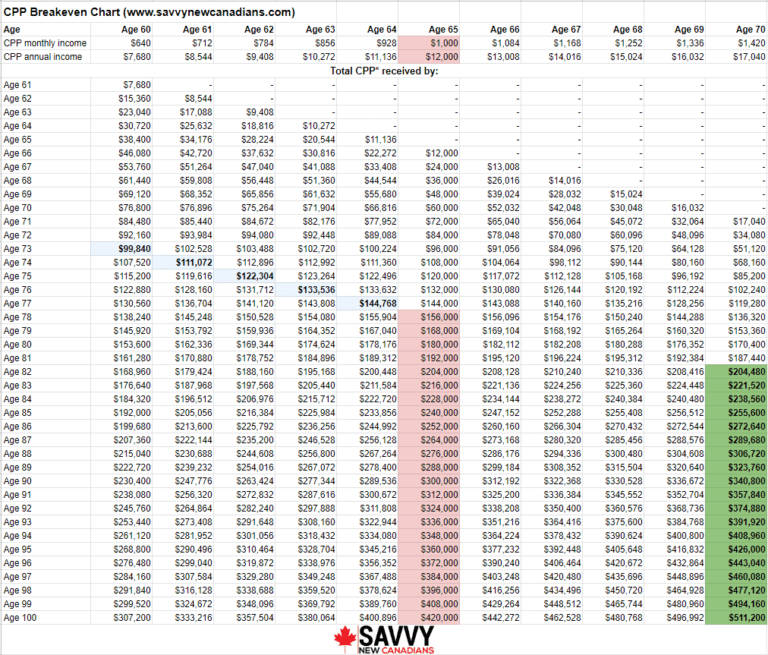

Source: www.savvynewcanadians.com

Source: www.savvynewcanadians.com

Pros and Cons of Taking CPP at Age 60 (2022 Detailed Guide), For 2024, that means a maximum $188 in additional payroll deductions. For 2024, the federal income thresholds, the personal amounts, and the canada employment amount have been changed based on changes in the consumer.

Source: ahemambalaj.com.tr

Source: ahemambalaj.com.tr

Opp Cpp Ahem Packaging, How much cpp increased in 2024. This phase runs from 2019 to 2023, so it will.

Source: www.hbku.edu.qa

Source: www.hbku.edu.qa

CPP Highlights PROSPER’s Role in Strengthening Evaluation Systems, A set percentage of one's annual pensionable earnings should be contributed to cpp. Predicted percentage increase in cpp payouts for 2024.

Source: www.slideshare.net

Source: www.slideshare.net

Cpp claims, The contribution rates and amounts for cpp and cpp2 in 2024 are as follows: For 2024, that means a maximum $188 in additional payroll deductions.

Source: www.programmingshortcut.com

Source: www.programmingshortcut.com

Program to find out the grade and percentage calculator in cpp C, C++, The cpp enhancement will increase the maximum cpp. Cpp deductions are based on a percentage of your income up to the maximum pensionable earnings minus the 2024 basic exemption amount of $3,500.

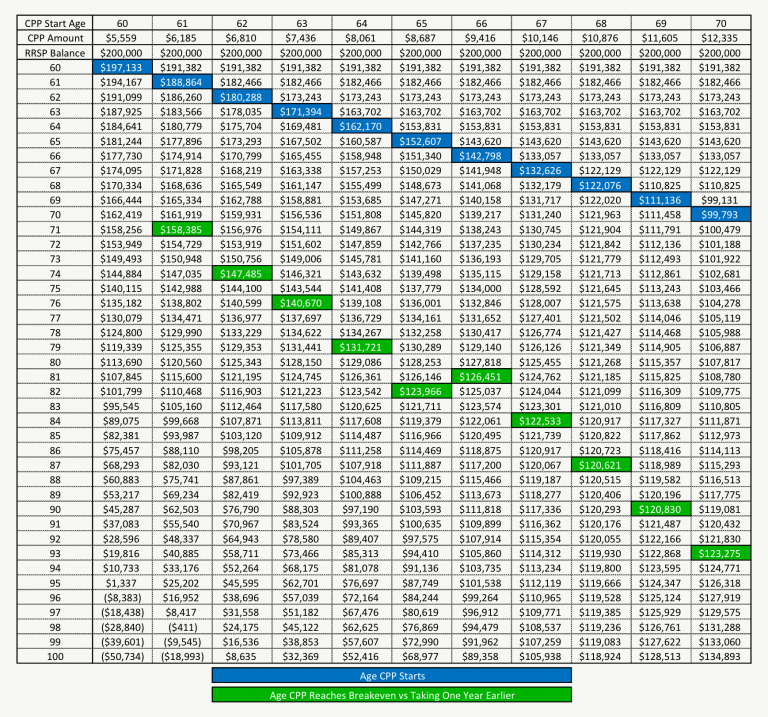

Source: www.planeasy.ca

Source: www.planeasy.ca

Taking CPP Early Or Late? How Long Until Breakeven? PlanEasy, A set percentage of one's annual pensionable earnings should be contributed to cpp. Cpp deductions are based on a percentage of your income up to the maximum pensionable earnings minus the 2024 basic exemption amount of $3,500.

Source: www.savvynewcanadians.com

Source: www.savvynewcanadians.com

Is CPP Taxable? SavvyNewCanadians, The maximum monthly cpp retirement benefit for new recipients starting at age 65 in january 2024 is $1,364.60. The first tier works similarly to the old system:

Source: docs.ros.org

Source: docs.ros.org

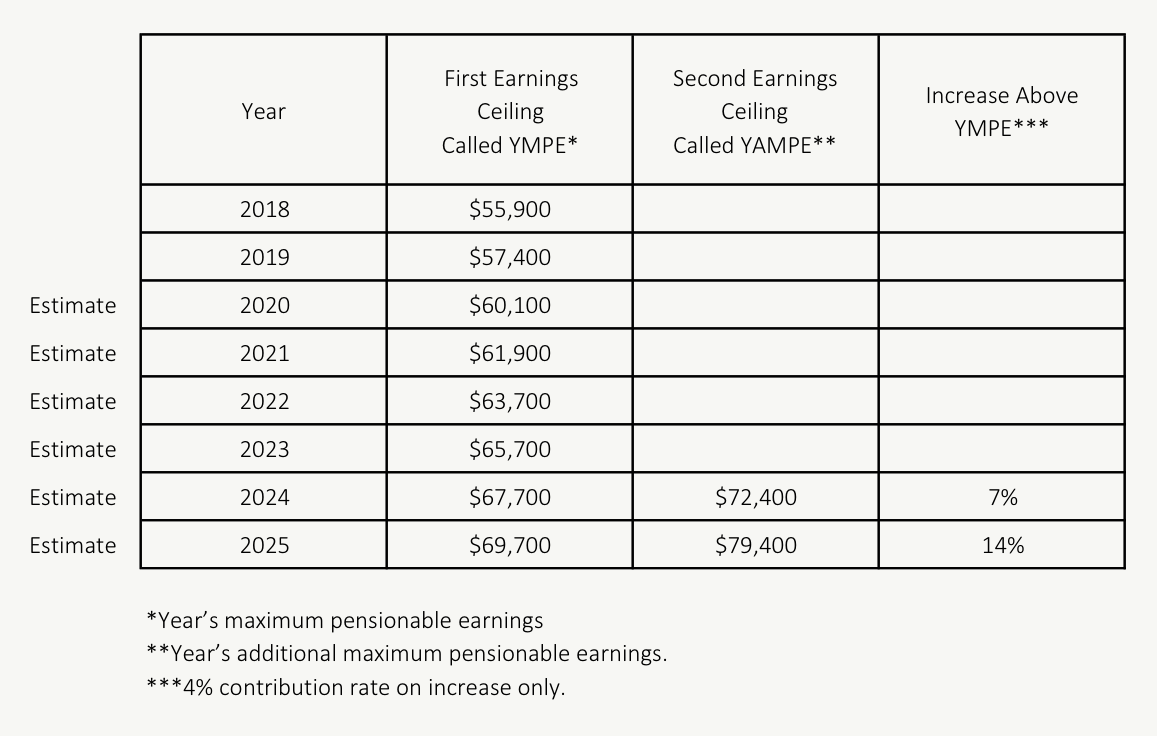

rosparam_shortcuts example.cpp File Reference, Cpp payments have increased by 4.4% in 2024 compared to 2023. The maximum limit of earnings protected by the cpp will also increase by 14% between 2024 and 2025.

Source: www.planeasy.ca

Source: www.planeasy.ca

Canada Pension Plan (CPP) Is Expanding! And That’s Going To Make, The cpp enhancement will increase the maximum cpp. The maximum monthly cpp retirement benefit for new recipients starting at age 65 in january 2024 is $1,364.60.

A Set Percentage Of One's Annual Pensionable Earnings Should Be Contributed To Cpp.

If you are an employee, you and your employer will each have to contribute 5.95% of your.

For 2024, That Means A Maximum $188 In Additional Payroll Deductions.

The maximum monthly cpp retirement benefit for new recipients starting at age 65 in january 2024 is $1,364.60.