Capital Gains Tax 2024/25 Uk

Capital Gains Tax 2024/25 Uk. We will delve into the specifics of cgt, how it applies to gold transactions in the uk, and. The primary tax in question and associated with selling gold is the capital gains tax (cgt).

For the current tax year (2024/25), the cgt allowance is £3,000. We will also consider how to.

When You Earn More Than £3,000.

Uk capital gains tax rates.

What You Pay It On, Rates And Allowances;

We will delve into the specifics of cgt, how it applies to gold transactions in the uk, and.

Capital Gains Tax 2024/25 Uk Images References :

Source: vickyqrobena.pages.dev

Source: vickyqrobena.pages.dev

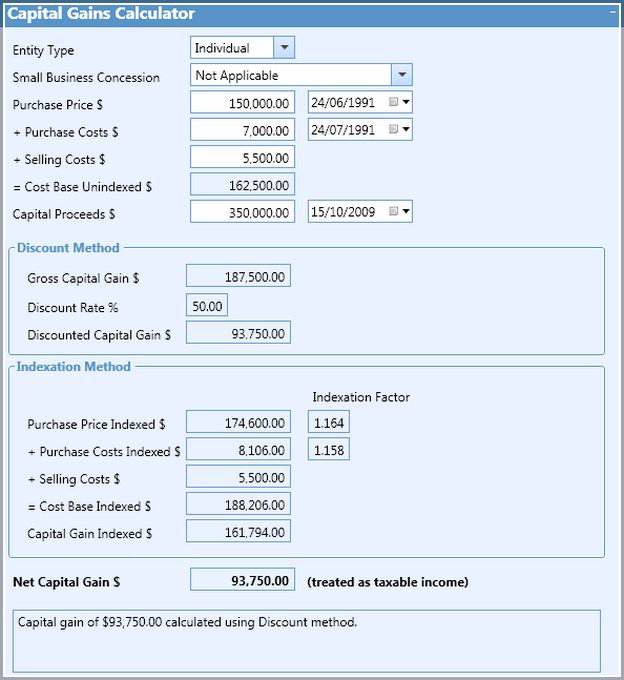

Capital Gains Tax Calculator 2024 Uk Elisha Chelsea, Report and pay your capital gains tax What you pay it on, rates and allowances;

Source: goldaqbernice.pages.dev

Source: goldaqbernice.pages.dev

Capital Gains Tax 2024 Gov Uk Wendy Joycelin, For the 2024 to 2025 tax year the allowance is £3,000, which leaves £9,600 to pay tax on. In this article we explai n how it works in more detail.

Source: jemmynolana.pages.dev

Source: jemmynolana.pages.dev

Capital Gains Tax Calculator 2024/25 Vita Aloysia, Capital gains tax (applies to all uk): For the tax year 2024 to 2025 and subsequent tax years the aea will be permanently fixed at £3,000 for individuals and personal representatives, and £1,500 for most trustees.

Source: koribellanca.pages.dev

Source: koribellanca.pages.dev

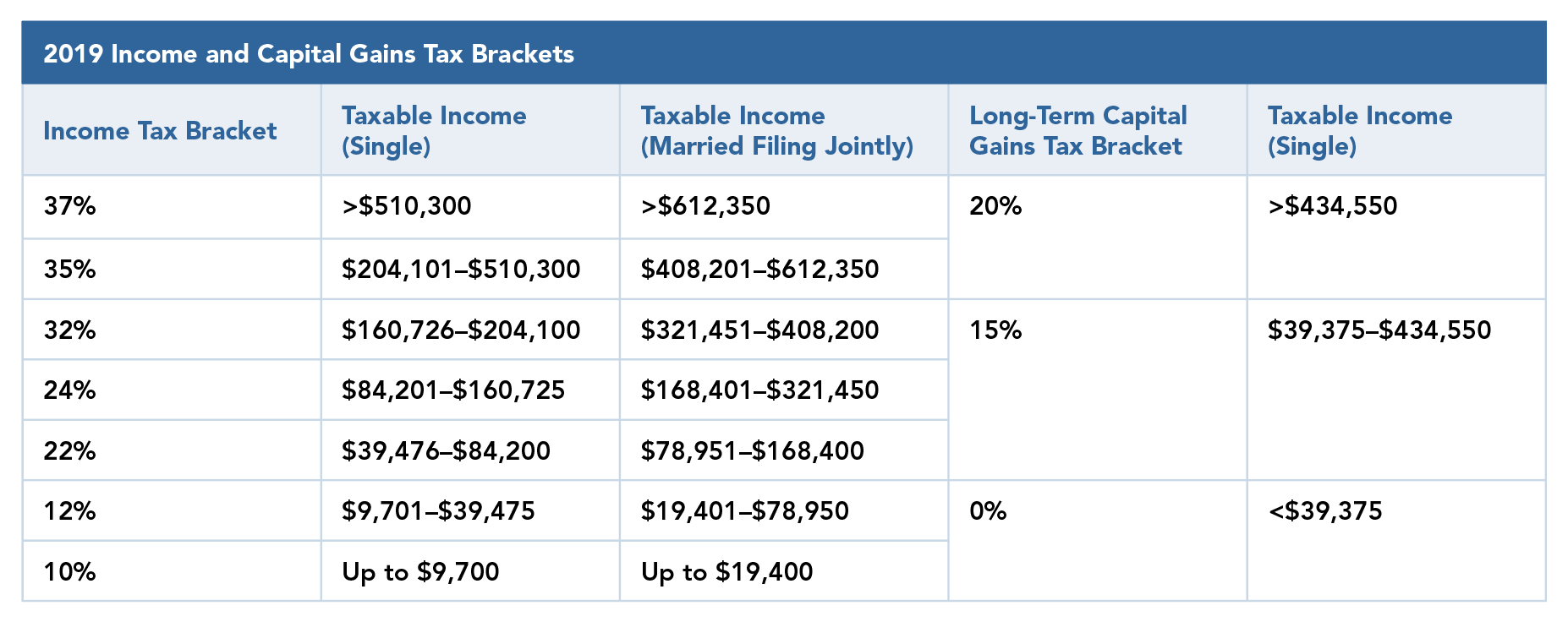

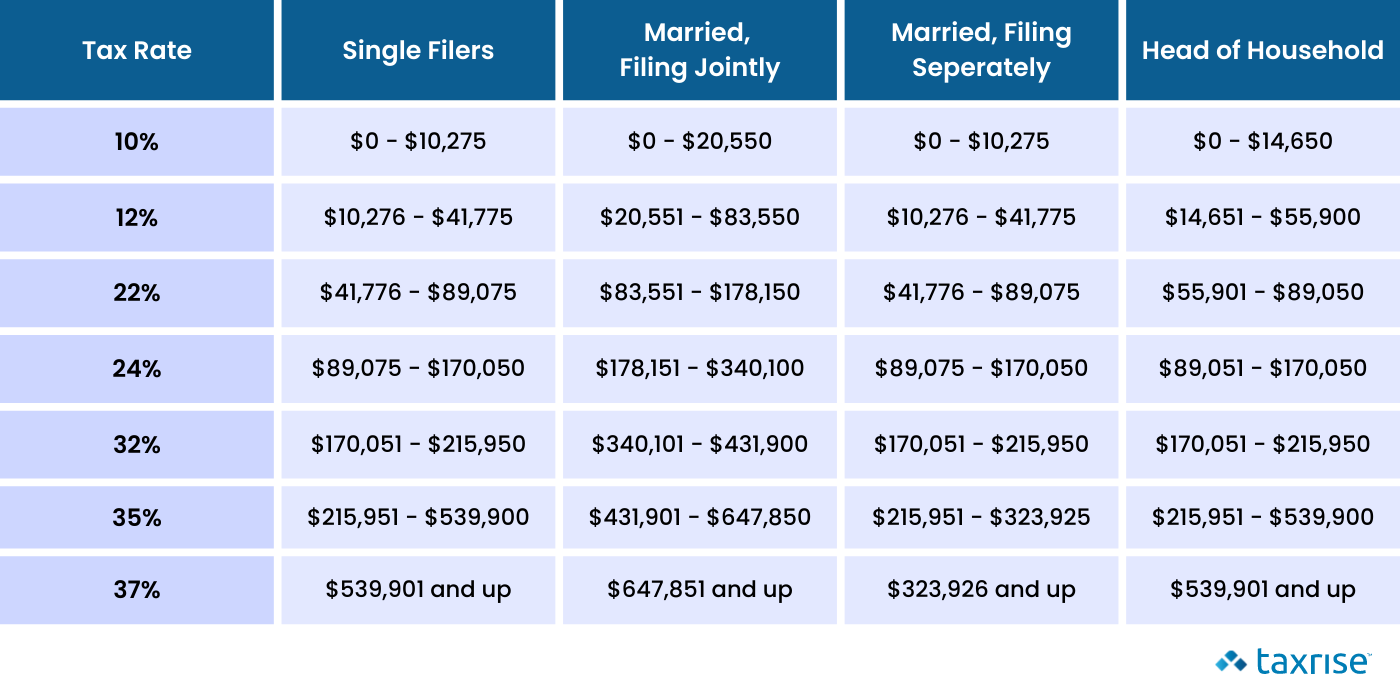

Capital Gains Tax 2024 Shina Octavia, Add this to your taxable income. Capital gains tax rates in the uk for 2024/25.

Source: www.kkcpa.ca

Source: www.kkcpa.ca

Capital Gains and Taxes What You Need to Know in 2023 » K.K. Chartered, Because the combined amount of £29,600 is less than. This is a 24% cgt liability.

Source: 2022cgr.blogspot.com

Source: 2022cgr.blogspot.com

What Is The Capital Gains Tax Rate For 2022 2022 CGR, It’s the gain you make that’s taxed, not the amount of money. This is a 24% cgt liability.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

ShortTerm And LongTerm Capital Gains Tax Rates By, Up to basic rate band (£37,700): For the 2024 to 2025 tax year the allowance is £3,000, which leaves £9,600 to pay tax on.

Source: taxrise.com

Source: taxrise.com

Cryptocurrency Taxes A Complete Tax Guide For All Cryptocurrencies For, Add this to your taxable income. This is a 24% cgt liability.

Source: roseblurleen.pages.dev

Source: roseblurleen.pages.dev

Uk Capital Gains Tax Allowance 2024 Dyane Grethel, In this article we explai n how it works in more detail. For the tax year 2024 to 2025 and subsequent tax years the aea will be permanently fixed at £3,000 for individuals and personal representatives, and £1,500 for most trustees.

Source: ddenebernestine.pages.dev

Source: ddenebernestine.pages.dev

Tax Brackets 2024/25 Uk Valli Isabelle, It’s the gain you make that’s taxed, not the amount of money. Add this to your taxable income.

Capital Gains Tax (Applies To All Uk):

For the current tax year (2024/25), the cgt allowance is £3,000.

Up To Basic Rate Band (£37,700):

Gains made on disposals of residential property that do not qualify for prr are chargeable to cgt at 18% for any gains that fall within an individual’s unused basic rate.